Do you know how to actually trade the daily or weekly watchlists published by your favorite FinTech Guru on Twitter? @swan1427 and @thetawarrior are a couple of my favorites who post consistently insane levels that you can follow.

For the purposes of this post I will be reviewing how to trade Swans Daily watchlist.

Be sure to watch Swan’s YouTube video first.

Patience

The idea behind the watchlist is to wait for the price to close above or below the call/put levels which are treated as key areas of support or resistance.

For Swan’s watchlist, we want to:

- Wait for a 3 minute candle to close above the CALL trigger, or the 3 minute candle to close below the PUT trigger.

- Wait for the first 15 minutes of the market to shake out before looking for your entry. This helps avoid some of the opening volatility usually experienced.

I also like to combine the Swan levels with the Opening Range Breakout strategy to help provide Price Targets as well as identifying other levels of support and resistance when entering or exiting a trade.

How I trade these watchlists with ORB

As you can see on the charts below, I have the CALL and PUT levels rendered as the thick green line and thick red line. I also have my Trading View ORB indicator overlayed.

The entries are triggered based on the Swans levels. In the case of $ABNB on Feb 14, you can see there was a chance early on soon after the first 15 miniutes passed to enter a trade on a retest and hold of the CALL level. Often you may get a gap up or large breakout of a level, and rather than chasing you should wait for a retest and hold of the level for confirmation of entry.

ENTERING A TRADE

BREAKOUT ENTRY:

3 minute candle closes over the level

RETEST ENTRY:

These are usually safer - you wait for the price to come back to retest the level (Break Hook and Go). If it tests the level, and holds / bounces and the next candle also closes above the level then you have a successful retest.

NECKLINE CONFIRMATION:

If you have a retest scenario shortly after a small breakout over the line, then you wait for that neckline to also break as it could act as a resistance level preventing further movement.

EXITING A TRADE

Before you have entered a trade, you need to know your exit strategy. As we are using the Swan levels to define our entry, it is also a good level to use as a stop loss.

STOP LOSS:

If the candle closes under the level you entered at then you should cut quickly and look for another chance to enter. Minimizing losses is key to being a successful trader.

TAKE PROFITS:

Profits should be taken often as the price moves in your direction. Using the ORB strategy, one can define price targets based on 50% retracement levels.

Examples

In the examples below, ideal times to start taking profits are at the ORB levels, and PT1 (magenta) and PT2 (cyan).

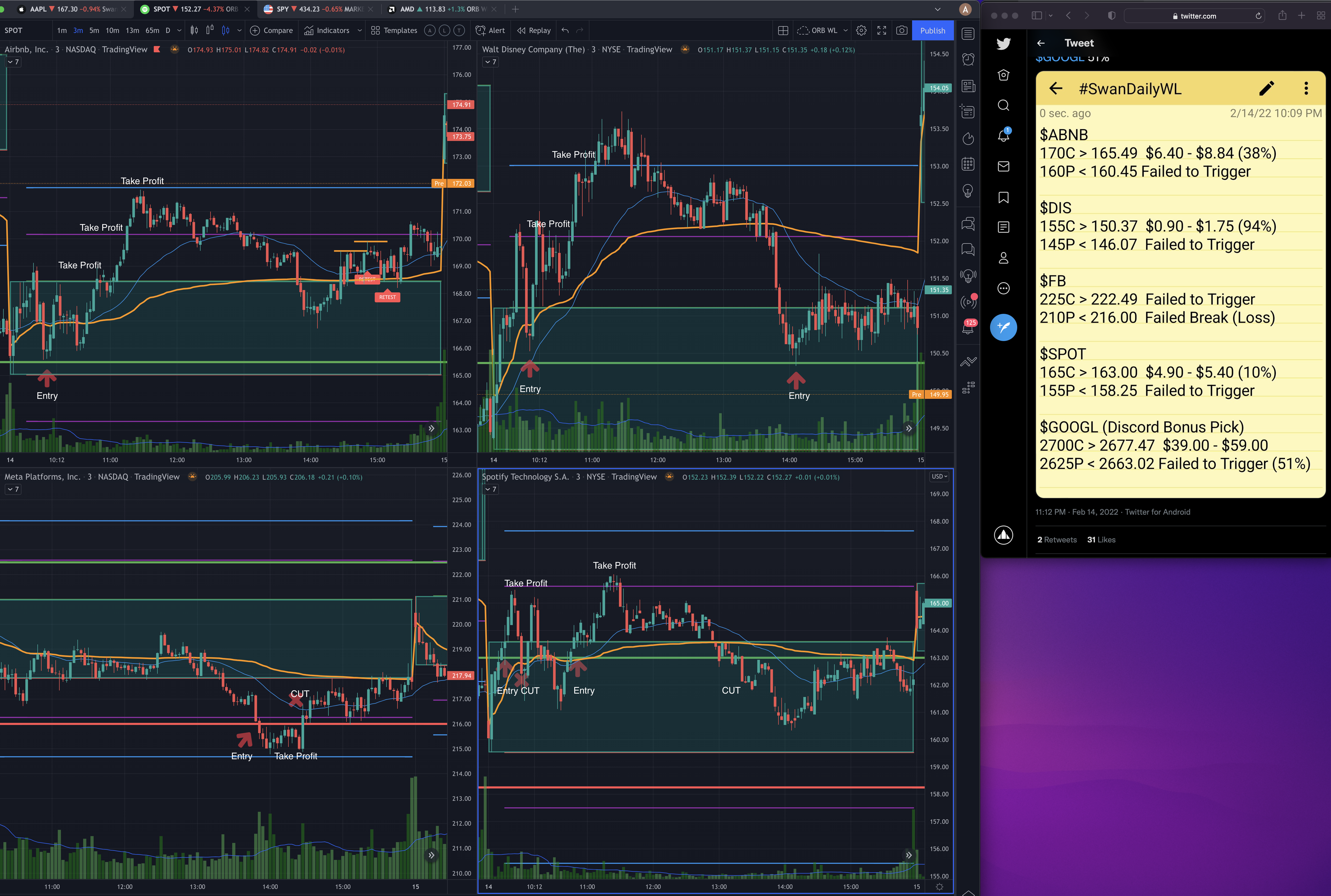

Feb 14 - $ABNB $DIS $FB $SPOT

- $ABNB - Entry on retest of CALL level. Better above VWAP/34ema. Take profits at ORBH, PT1, and PT2.

- $DIS - Entry on retest of CALL level or break of ORBH. Scale out at PT1 and PT2.

- $FB - Enter on break of PUT level. Take profit at PT2. This is risky as already extended on sell side. Stop above PUT level.

- $SPOT - Enter on retest of CALL level. Take profit at PT1. Stops on close below Call Level.

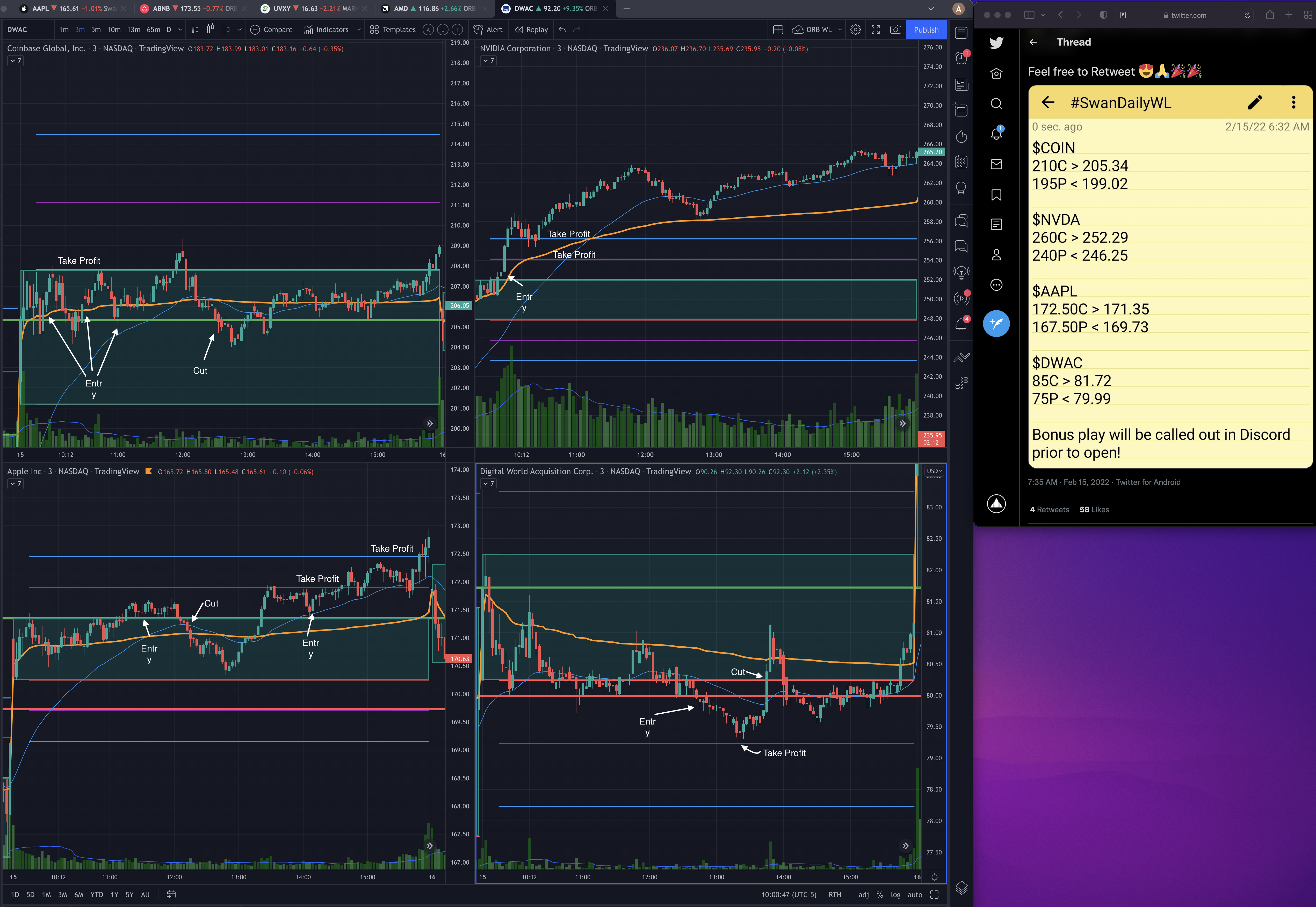

Feb 15 - $COIN $NVDA $AAPL $DWAC

- $COIN - Multiple retests on the CALL trigger line for an entry. Take profits at ORBH. Stop below the Call Level (or break of 34ema)

- $NVDA - Enter on break of Call trigger (which aligned with ORBH). Take profits at PT1 and PT2 or ride the 34ema.

- $AAPL - Enter on break of Call Trigger, Cut below Call Trigger. Profts at PT1 and PT2. First one failed. Second chance succeeded.

- $DWAC - Enter pn break of PUT trigger. Take profit at PT1. Cut on push back over PUT level or ORBL depending on risk tolerance.

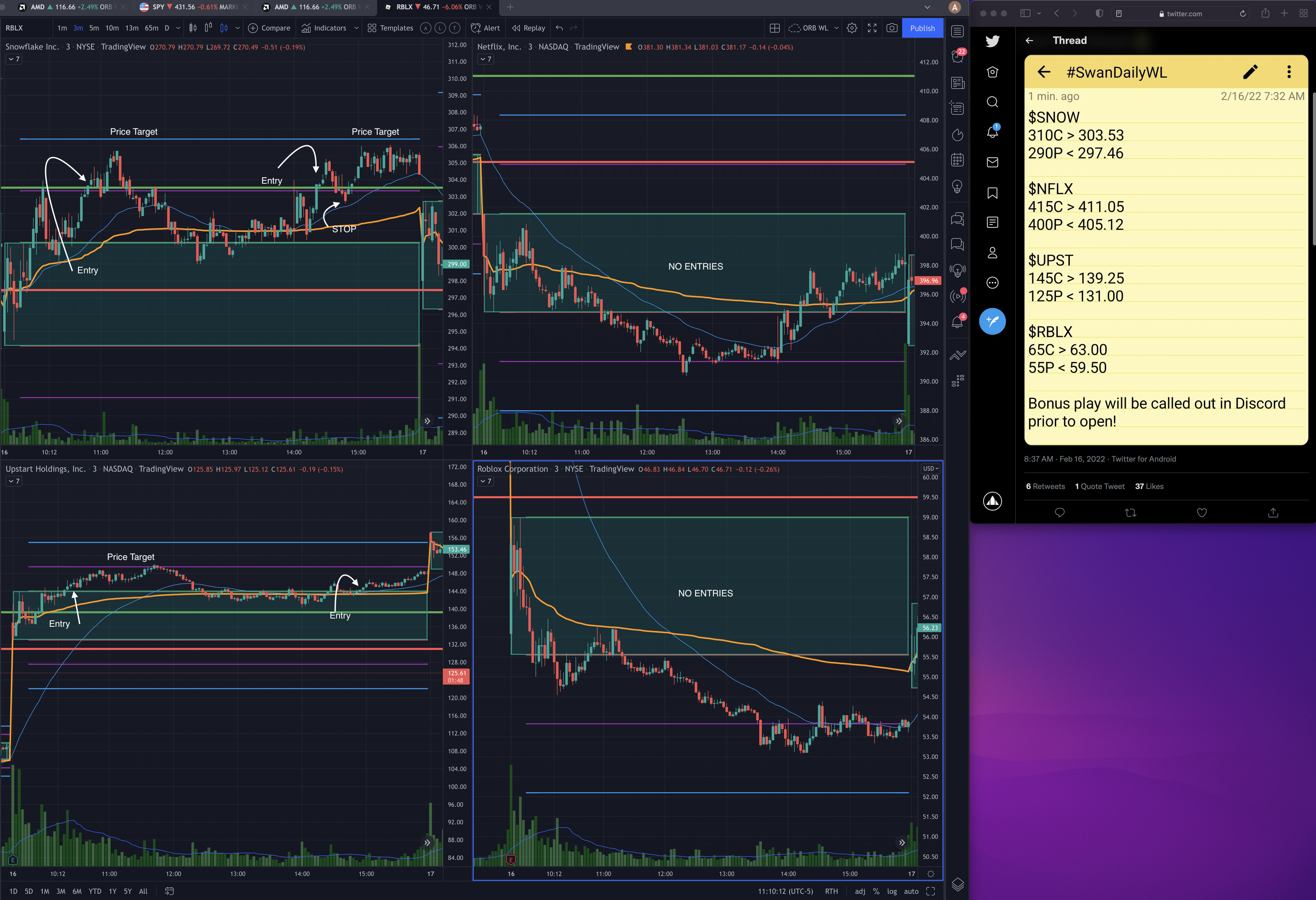

Feb 16 - $SNOW $NFLX $UPST $RBLX

- $SNOW - enter on break of CALL level. Take profits at PT2 (cyan). Stop below Call level.

- $NFLX - no entries due to gap down. Could play ORBL levels if inclined.

- $UPST - enter on break of Call level or ORBH (watch VWAP level). Take profits at PT1.

- $RBLX - no entries due to gap down. Could play ORBL levels.

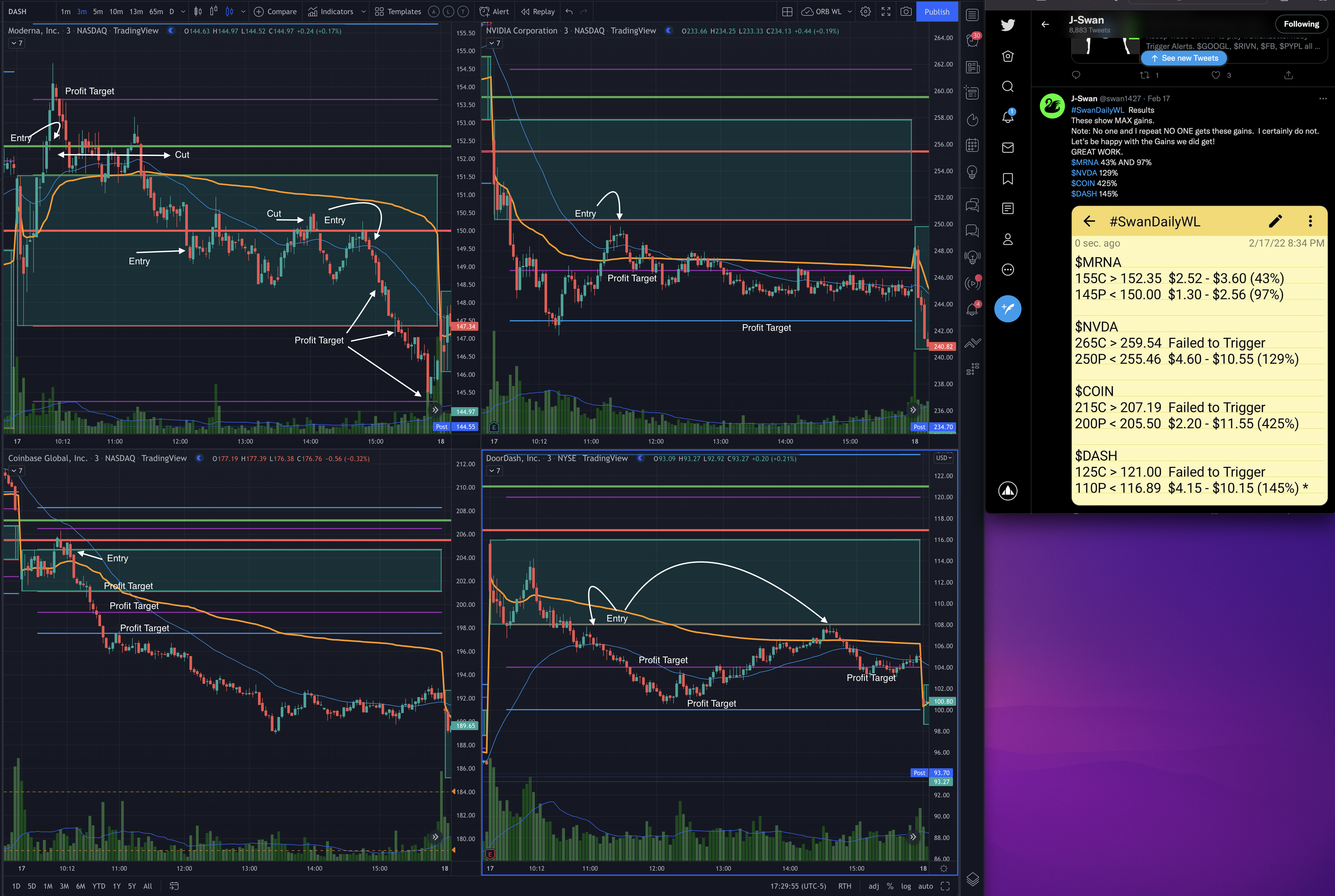

Feb 17 - $MRNA, $NVDA, $COIN, $DASH

- $MRNA - Entry on breakout of Call Level (risky due to momo). Cut below Call level, Take profits at PT1. Second entry on PUT level break, cut above PUT level. Third Put entry worked with profit taking at ORBL and PT1.

- $NVDA - Gap down, but can enter on retest of ORBL. Take profit at PT1.

- $COIN - Enter on retest of PUT level. Take profits at ORBL, PT1, and PT2.

- $DASH - Gap down, but can enter on retest of ORBL. Take profits at PT1, and PT2.

Feb 18 - $TSLA, $MSFT, $SNOW, $AAPL

- $TSLA - Enter on retest of PUT level. Take profits at ORBL, PT1, and PT2. Another possible entry at retest of ORBL.

- $MSFT - Enter on break/retests of PUT level (3 chances). Take profits at PT1 and PT2.

- $SNOW - Enter on break of PUT level. Take profits at PT2 or follow 34ema.

- $AAPL - Enter on retest of PUT level and break of ORBL. Take profits at PT1 and 34ema cross.