As a trader, you’re always looking for an edge that can help you make profitable trades.

One way to gain an edge is to track the flow of options – the buying and selling activity of options contracts by different market participants.

By understanding who is buying and selling options, and why, you can uncover hidden opportunities and make better-informed trading decisions.

Options Flow Trading

Options flow trading is a type of trading strategy that focuses on tracking the flow of options contracts, rather than the underlying stocks or other assets.

By analyzing the options flow data, traders can identify potential trading opportunities and make decisions based on the underlying supply and demand dynamics of the options market.

ADVANTAGE ONE

One key advantage of options flow trading is that it can provide valuable insights into the sentiment and positioning of different market participants.

For example, if you see a large influx of options contracts being bought by institutional investors, it could be a sign that they are bullish on the underlying stock or asset.

On the other hand, if you see a surge in options contracts being sold by retail traders, it could indicate that they are bearish on the underlying asset.

By tracking these trends and identifying shifts in sentiment, you can gain valuable insights into the market and make more informed trading decisions.

ADVANTAGE TWO

Another advantage of options flow trading is that it can help you identify potential trading opportunities that may not be apparent from looking at the underlying stock or asset.

For example, if you see a large volume of options contracts being bought at a specific strike price, it could indicate that there is underlying demand for the stock or asset at that level.

This could be a potential entry or exit point for your trade, depending on your own analysis and market conditions.

Overall, options flow trading can provide valuable insights into the sentiment and positioning of different market participants, and help you identify potential trading opportunities that may not be apparent from looking at the underlying stock or asset. By incorporating options flow data into your trading strategy, you can gain an edge and make more profitable trades.

Signing up for Options Flow

There are two tools I recommend for Options Flow.

UNUSUAL WHALES

Unusual Whales is a subscription-based service that provides real-time alerts for large, out-of-the-ordinary trades in the options market.

The service is designed to provide traders with an edge by helping them identify large trades that are taking place, which could indicate a shift in sentiment and the potential for profitable opportunities.

Unusual Whales offers both real-time and historical alert data, as well as a heat map which highlights unusual activity.

BLACK BOX STOCKS (recommended)

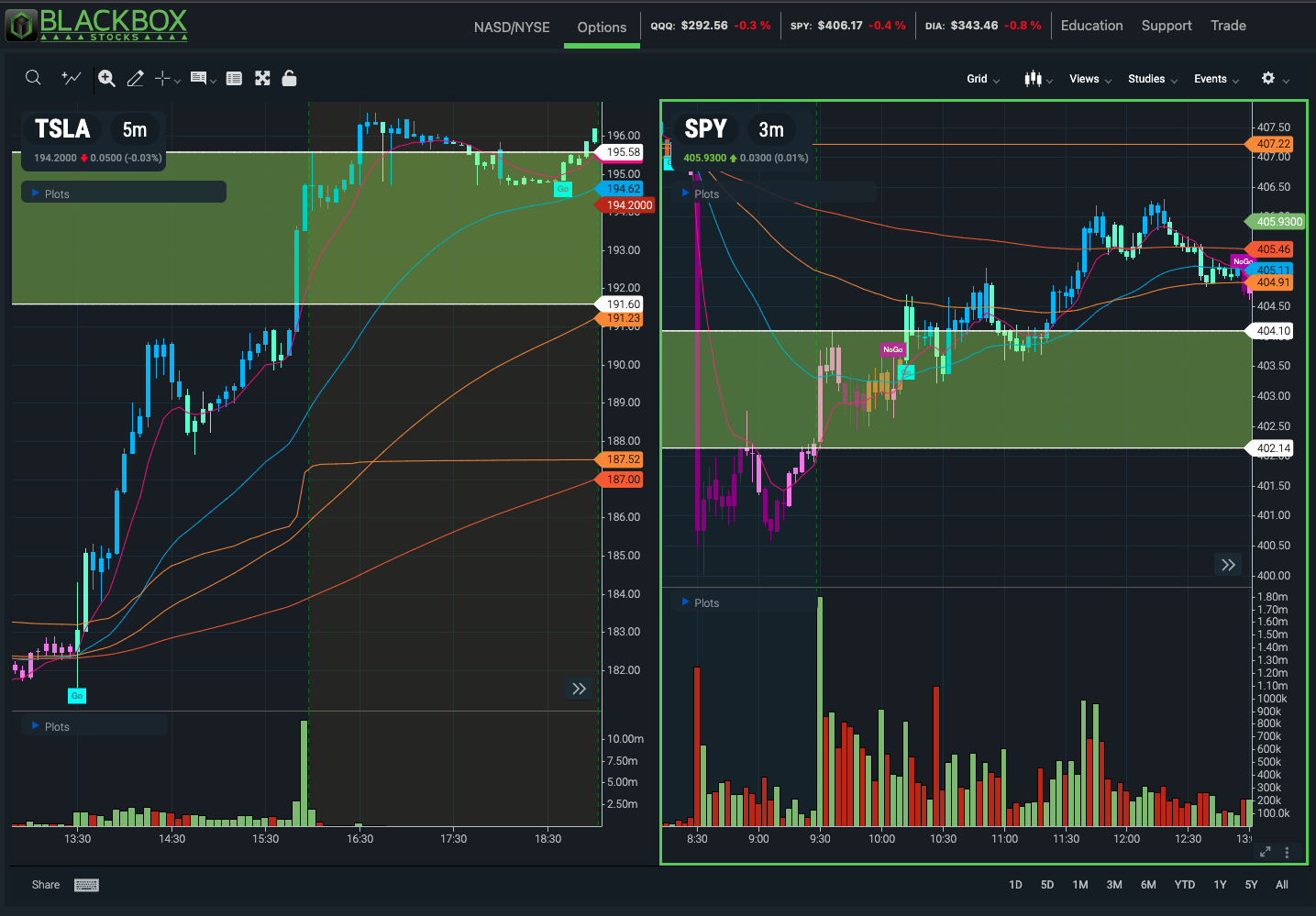

BlackBoxStocks is a data platform that provides traders with real-time options flow data.

The platform offers a variety of data points such as volume, open interest, and implied volatility.

BlackBoxStocks also provides a heat map which highlights unusual activity, as well as the ability to create custom alerts.

Additionally, the platform provides a suite of tools to help traders analyze and manage their options trades with cutting edge charting tools.

BlackBoxStocks is designed to provide traders with an edge by helping them identify profitable opportunities in the options market.

Personally, I am a BIG fan of Black Box Stocks. Not only do you get the great Options Flow from them, but they have an insanely great team of traders to guide you throughout the day on live voice and discord, and point out interesting flow.

They frequently give out trade alerts worth following, as well as teach you how to trade (both Options Flow Trading as well as Technical Analysis).

I have been a member of BlackBoxStocks for a few years now and has been worth every penny.

You can sign up to Black Box Stocks with my affiliate link: Black Box Stocks